Understanding Maximum Taxable Earnings: A Guide for US Workers

Table of Contents

- Ssi Income Limits 2024 - Gill Cathyleen

- Income Limits For Social Security In 2019 | carfare.me 2019-2020

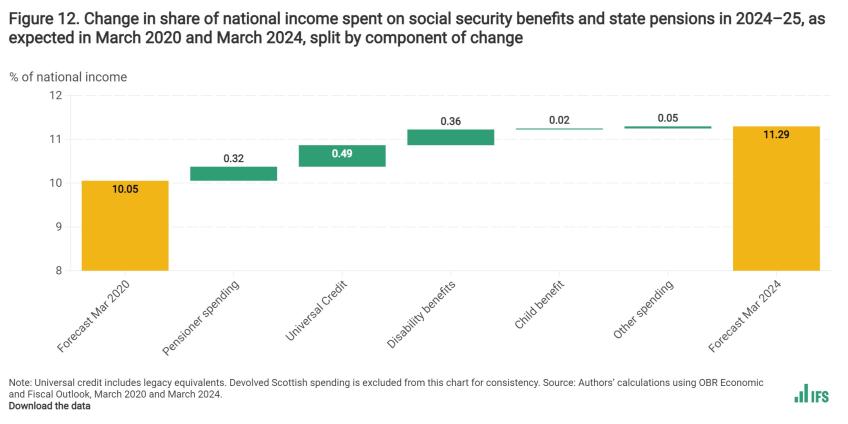

- Charts, graphs and data | Institute for Fiscal Studies

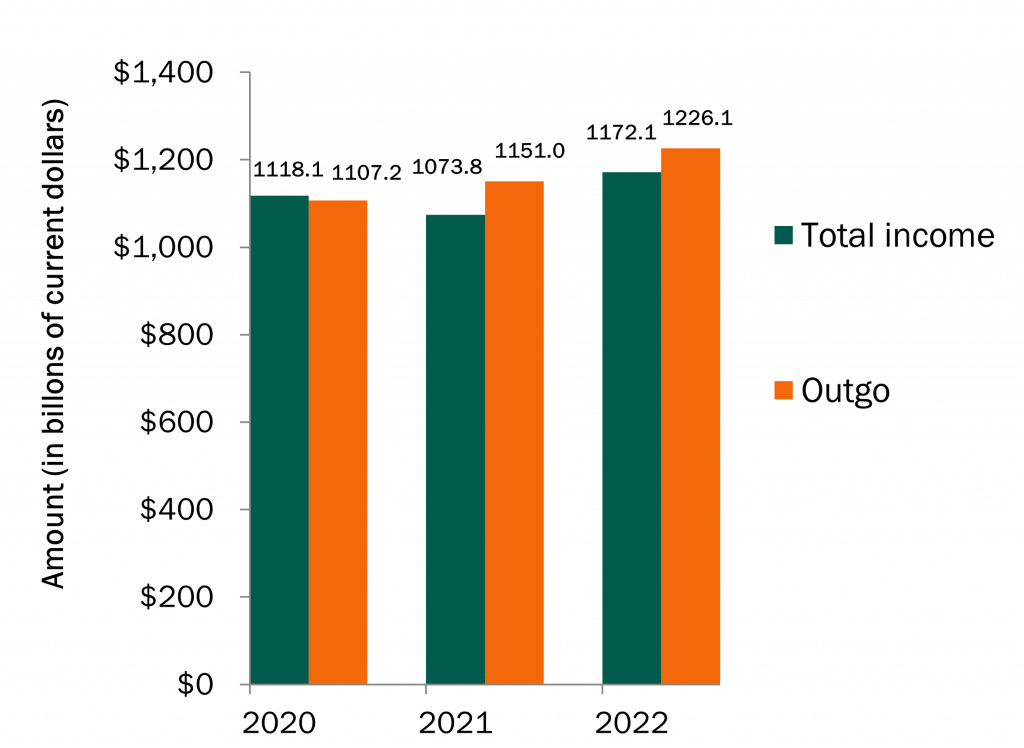

- Social Security Benefits, Finances, and Policy Options: A Primer ...

- Social Security Administration Proposes 2 Much-Needed Changes, But ...

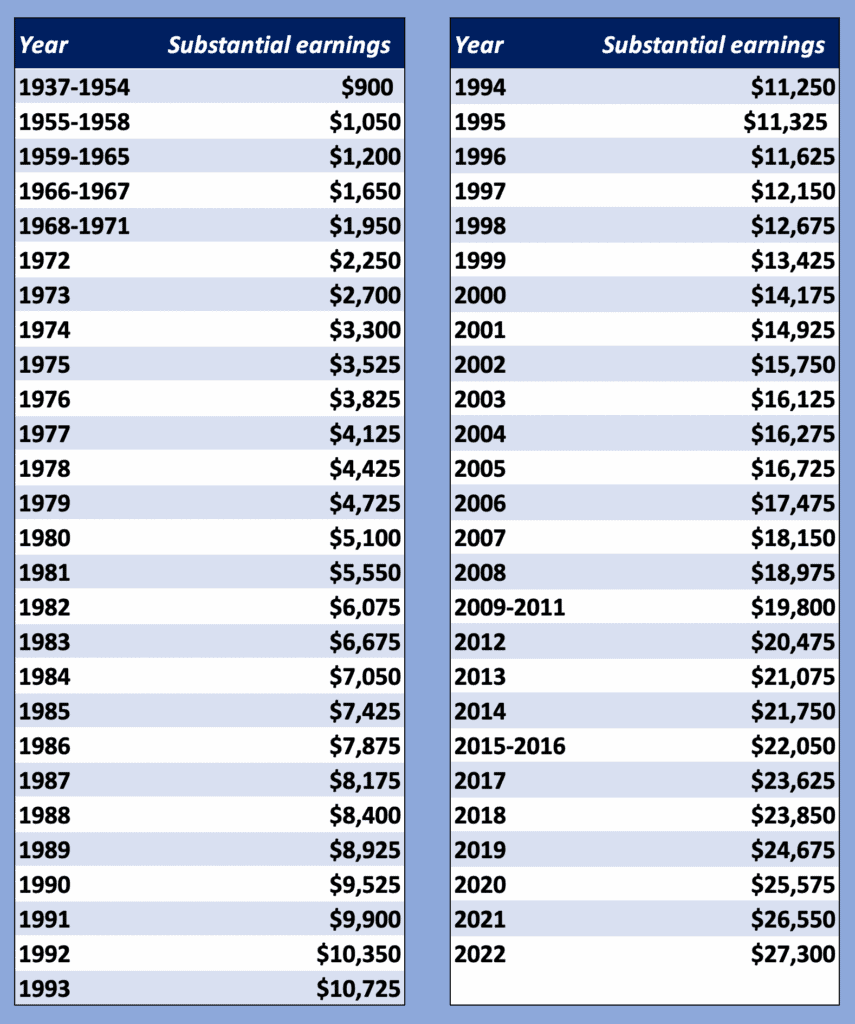

- Social Security Earned Income Limit 2024 Chart - Mora Tabbie

- Social Security Benefits, Finances, and Policy Options: A Primer ...

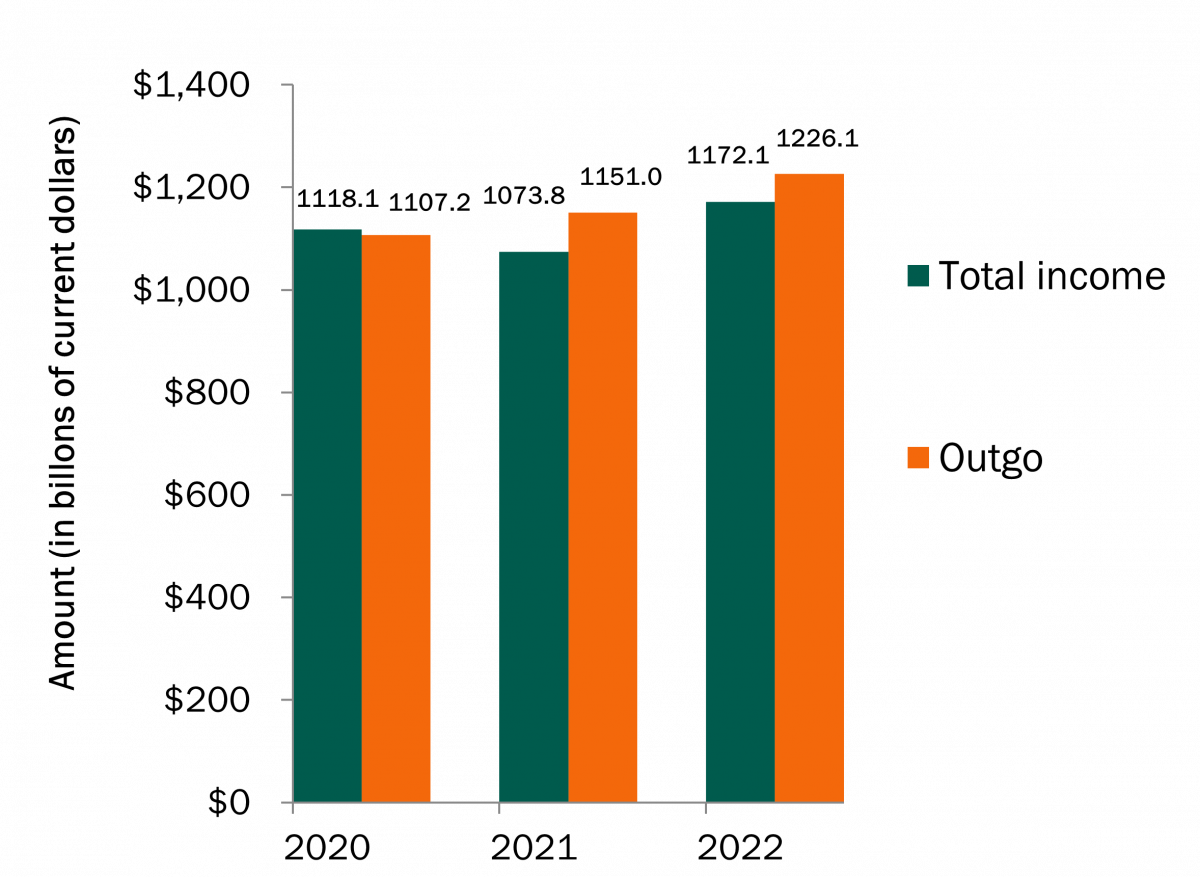

- Is Social Security Going Broke? - The Center For Garden State Families

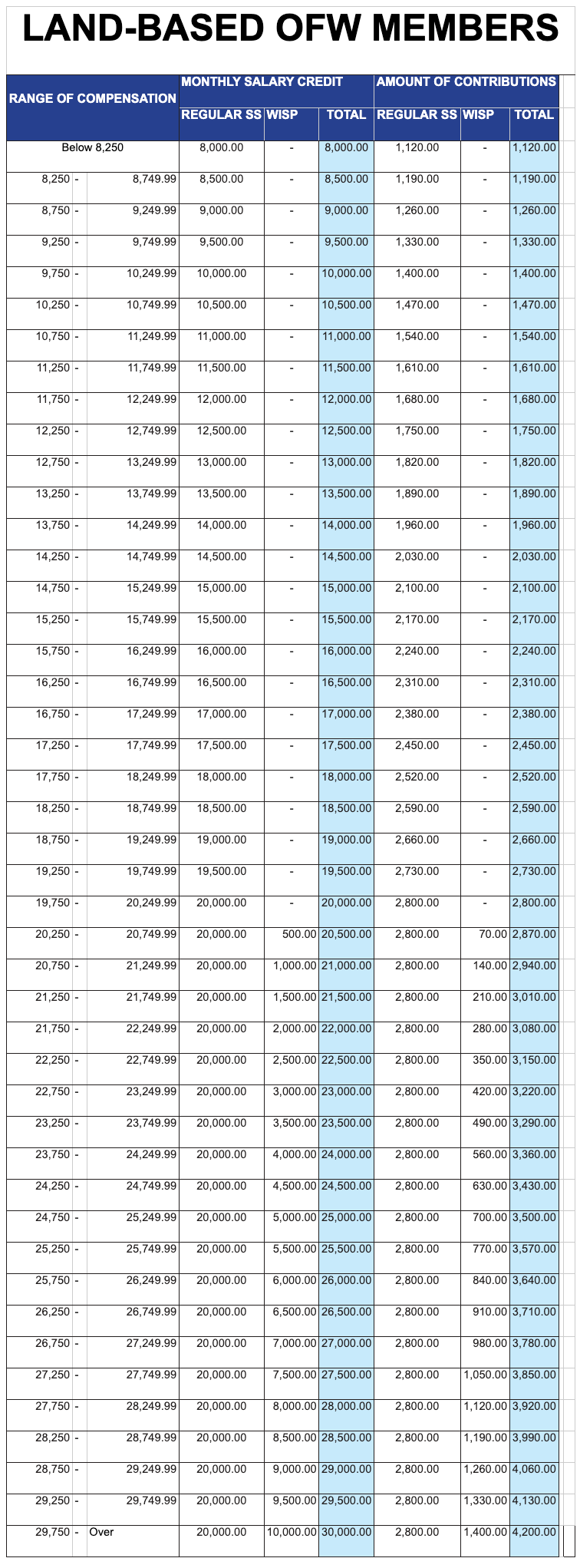

- 2024 SSS Contribution Tables & Schedules for All Members

- Social Security Administration Proposes 2 Much-Needed Changes, But ...

What are Maximum Taxable Earnings?

How are Maximum Taxable Earnings Calculated?

Impact on Social Security Benefits

Maximum taxable earnings can have a significant impact on Social Security benefits. Workers who earn above the maximum taxable earnings limit may not see an increase in their Social Security benefits, even if they earn more income. This is because Social Security benefits are calculated based on a worker's 35 highest-earning years, and any income earned above the maximum taxable earnings limit is not considered in the calculation.

Examples of Workers with Maximum-Taxable Earnings

Let's consider a few examples to illustrate the concept of maximum taxable earnings: John, a software engineer, earns $200,000 per year. Since the maximum taxable earnings limit is $147,000, John's income above $147,000 is not subject to Social Security taxes. Emily, a marketing manager, earns $120,000 per year. Since her income is below the maximum taxable earnings limit, her entire income is subject to Social Security taxes. David, a self-employed entrepreneur, earns $300,000 per year. Like John, David's income above $147,000 is not subject to Social Security taxes. In conclusion, understanding maximum taxable earnings is essential for US workers who want to maximize their Social Security benefits. By knowing the maximum taxable earnings limit, workers can plan their income and retirement strategy accordingly. While maximum taxable earnings may seem like a complex concept, it is an important aspect of the US Social Security system. As workers navigate their careers and plan for retirement, it is crucial to consider the impact of maximum taxable earnings on their Social Security benefits. By following the guidelines outlined in this article, workers can make informed decisions about their income and retirement planning, ensuring a secure financial future. Whether you are a high-earning professional or a self-employed entrepreneur, understanding maximum taxable earnings can help you maximize your Social Security benefits and achieve your retirement goals.For more information on maximum taxable earnings and Social Security benefits, visit the Social Security Administration website. Additionally, you can consult with a financial advisor or tax professional to determine how maximum taxable earnings may impact your individual situation.